ACG2021-Connect Ch.4

Required information

Allied

Merchandisers was organized on May 1. Macy Co. is a major customer (buyer) of

Allied (seller) products.

May

|

3

|

Allied

made its first and only purchase of inventory for the period on May 3 for

1,000 units at a price of $10 cash per unit (for a total cost of $10,000).

|

||

5

|

Allied

sold 500 of the units in inventory for $14 per unit (invoice total: $7,000)

to Macy Co. under credit terms 2/10, n/60. The goods cost Allied $5,000.

|

|||

7

|

Macy

returns 50 units because they did not fit the customer’s needs (invoice

amount: $700). Allied restores the units, which cost $500, to its inventory.

|

|||

8

|

Macy

discovers that 50 units are scuffed but are still of use and, therefore,

keeps the units. Allied sends Macy a credit memorandum for $300 toward the

original invoice amount to compensate for the damage.

|

|||

15

|

Allied

receives payment from Macy for the amount owed on the May 5 purchase; payment

is net of returns, allowances, and any cash discount.

|

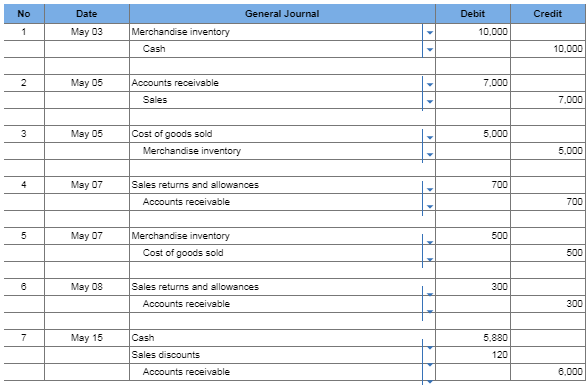

Prepare journal entries to record the following transactions for

Allied assuming it uses a perpetual inventory system and the gross method.

(Allied estimates returns using an adjusting entry at each year-end.)

Explanation

May

|

3:

|

Purchased

goods. (1,000 units x $10). = $10,000.

|

||

May

|

5:

|

Sold

goods on credit. (500 units x $14). = $7,000.

|

||

May

|

5:

|

Record

cost of sale. (500 units x $10). = $5,000.

|

||

May

|

7:

|

Accepted

returns. (50 units x $14). = $700.

|

||

May

|

7:

|

Returned

goods to inventory. (50 units x $10). = $500.

|

||

May

|

15:

|

Sales

discount received payment within discount period. ($7,000 – $700 – $300) x 2%

= $120.

|

||

May

|

15:

|

Accounts

receivable balance as of May 15. ($7,000 – $700 – $300) = $6,000.

|

Required information

Allied

Merchandisers was organized on May 1. Macy Co. is a major customer (buyer) of

Allied (seller) products.

May

|

3

|

Allied

made its first and only purchase of inventory for the period on May 3 for

1,000 units at a price of $10 cash per unit (for a total cost of $10,000).

|

||

5

|

Allied

sold 500 of the units in inventory for $14 per unit (invoice total: $7,000)

to Macy Co. under credit terms 2/10, n/60. The goods cost Allied $5,000.

|

|||

7

|

Macy

returns 50 units because they did not fit the customer’s needs (invoice amount:

$700). Allied restores the units, which cost $500, to its inventory.

|

|||

8

|

Macy

discovers that 50 units are scuffed but are still of use and, therefore,

keeps the units. Allied sends Macy a credit memorandum for $300 toward the

original invoice amount to compensate for the damage.

|

|||

15

|

Allied

receives payment from Macy for the amount owed on the May 5 purchase; payment

is net of returns, allowances, and any cash discount.

|

Prepare the appropriate journal entries for Macy Co. to record

each of the May transactions. Macy is a retailer that uses the gross method and

a perpetual inventory system, and purchases these units for resale. (If no entry is required for a

transaction/event, select "No journal entry required" in the first

account field.)

Explanation

May

|

7:

|

Returned

unwanted merchandise. (50 units x $14) = $700.

|

||

May

|

15:

|

Accounts

payable paid for May 5 purchase less R&A. ($7,000 – $700 – $300) =

$6,000.

|

||

May

|

15:

|

Merchandise

inventory paid for May 5 purchase less R&A. ($7,000 – $700 – $300) x 2% =

$120.

|

The following list

includes selected permanent accounts and all of the temporary accounts from the

December 31, 2017, unadjusted trial balance of Emiko Co.. Emiko Co. uses a

perpetual inventory system.

Debit

|

Credit

|

||||

Merchandise

inventory

|

$

|

39,000

|

|||

Prepaid

selling expenses

|

7,400

|

||||

Dividends

|

51,000

|

||||

Sales

|

$

|

601,000

|

|||

Sales

returns and allowances

|

21,100

|

||||

Sales

discounts

|

6,800

|

||||

Cost of

goods sold

|

248,000

|

||||

Sales salaries

expense

|

66,000

|

||||

Utilities

expense

|

24,000

|

||||

Selling

expenses

|

45,000

|

||||

Administrative

expenses

|

123,000

|

||||

Additional Information

Accrued sales salaries amount to $1,600. Prepaid selling expenses of $2,700 have expired. A physical count of year-end merchandise inventory shows $34,100 of goods still available.

(a) Use the above account balances along with the additional information, prepare the adjusting entries.

(b) Use the above account balances along with the additional information, prepare the closing entries.

No Date General Journal Debit Credit

1 Dec 31 Sales 601,000

1 Income

summary 601,000

2 Dec 31 Income summary 543,100

2 Sales

returns and allowances 21,100

2 Sales

discounts 6,800

2 Cost

of goods sold 252,900

2 Sales

salaries expense 67,600

2 Utilities

expense 24,000

2 Selling

expenses 47,700

2 Administrative

expenses 123,000

3 Dec 31 Income summary 57,900

3 Retained

Earnings 57,900

4 Dec 31 Retained Earnings 51,000

4 Dividends 51,000

Prepare journal entries to record the following merchandising

transactions of Cabela’s, which uses the perpetual inventory system and the

gross method. (Hint: It will help to identify each receivable and payable; for

example, record the purchase on July 1 in Accounts Payable—Boden.)

July

|

1

|

Purchased merchandise

from Boden Company for $6,000 under credit terms of 2/15, n/30, FOB shipping

point, invoice dated July 1.

|

||

2

|

Sold merchandise to

Creek Co. for $950 under credit terms of 2/10, n/60, FOB shipping point,

invoice dated July 2. The merchandise had cost $500.

|

|||

3

|

Paid $110 cash for

freight charges on the purchase of July 1.

|

|||

8

|

Sold merchandise that

had cost $1,300 for $1,700 cash.

|

|||

9

|

Purchased merchandise

from Leight Co. for $2,700 under credit terms of 2/15, n/60, FOB destination,

invoice dated July 9.

|

|||

11

|

Received a $700 credit

memorandum from Leight Co. for the return of part of the merchandise

purchased on July 9.

|

|||

12

|

Received the balance

due from Creek Co. for the invoice dated July 2, net of the discount.

|

|||

16

|

Paid the balance due to

Boden Company within the discount period.

|

|||

19

|

Sold merchandise that

cost $1,000 to Art Co. for $1,500 under credit terms of 2/15, n/60, FOB

shipping point, invoice dated July 19.

|

|||

21

|

Issued a $250 credit

memorandum to Art Co. for an allowance on goods sold on July 19.

|

|||

24

|

Paid Leight Co. the

balance due, net of discount.

|

|||

30

|

Received the balance

due from Art Co. for the invoice dated July 19, net of discount.

|

|||

31

|

Sold merchandise that

cost $4,800 to Creek Co. for $6,900 under credit terms of 2/10, n/60, FOB

shipping point, invoice dated July 31.

|

No

|

Date

|

General Journal

|

Debit

|

Credit

|

1

|

July 01

|

Merchandise inventory

|

6,000

|

|

1

|

Accounts payable—Boden

|

6,000

|

||

2

|

July 02

|

Accounts

receivable—Creek

|

950

|

|

2

|

Sales

|

950

|

||

3

|

July 02

|

Cost of goods sold

|

500

|

|

3

|

Merchandise inventory

|

500

|

||

4

|

July 03

|

Merchandise inventory

|

110

|

|

4

|

Cash

|

110

|

||

5

|

July 08

|

Cash

|

1,700

|

|

5

|

Sales

|

1,700

|

||

6

|

July 08

|

Cost of goods sold

|

1,300

|

|

6

|

Merchandise inventory

|

1,300

|

||

7

|

July 09

|

Merchandise inventory

|

2,700

|

|

7

|

Accounts

payable—Leight

|

2,700

|

||

8

|

July 11

|

Accounts

payable—Leight

|

700

|

|

8

|

Merchandise inventory

|

700

|

||

9

|

July 12

|

Cash

|

931

|

|

9

|

Sales discounts

|

19

|

||

9

|

Accounts

receivable—Creek

|

950

|

||

10

|

July 16

|

Accounts payable—Boden

|

6,000

|

|

10

|

Merchandise inventory

|

120

|

||

10

|

Cash

|

5,880

|

||

11

|

July 19

|

Accounts

receivable—Art

|

1,500

|

|

11

|

Sales

|

1,500

|

||

12

|

July 19

|

Cost of goods sold

|

1,000

|

|

12

|

Merchandise inventory

|

1,000

|

||

13

|

July 21

|

Sales returns and

allowances

|

250

|

|

13

|

Accounts

receivable—Art

|

250

|

||

14

|

July 24

|

Accounts

payable—Leight

|

2,000

|

|

14

|

Merchandise inventory

|

40

|

||

14

|

Cash

|

1,960

|

||

15

|

July 30

|

Cash

|

1,225

|

|

15

|

Sales discounts

|

25

|

||

15

|

Accounts

receivable—Art

|

1,250

|

||

16

|

July 31

|

Accounts

receivable—Creek

|

6,900

|

|

16

|

Sales

|

6,900

|

||

17

|

July 31

|

Cost of goods sold

|

4,800

|

|

17

|

Merchandise inventory

|

4,800

|

Explanation

July

|

12

|

Sales Discounts ($950 ×

2%) = $19

|

||

16

|

Merchandise Inventory

($6,000 × 2%) = $120

|

|||

24

|

Merchandise Inventory

($2,000 × 2%) = $40

|

|||

30

|

Sales Discounts:

([$1,500 – $250] × 2%) = $25

|

Omg thank you so much for this XD your a life saver when homework is involved.

ReplyDeleteI really enjoy the blog.Much thanks again. Really Great Liquidweb Coupons

ReplyDeleteTHANK YOU

ReplyDeleteThank you!

ReplyDeleteThanks so much :)

ReplyDeleteOmgosh this is amazing but please tell me how you get the income summary of $543,100? I understand every step but this one!

ReplyDeleteYou a real one for this, thanks!

ReplyDeleteHalo,I'm Helena Julio from Ecuador,I want to talk good about Le_Meridian Funding Service on this topic.Le_Meridian Funding Service gives me financial support when all bank in my city turned down my request to grant me a loan of 500,000.00 USD, I tried all i could to get a loan from my banks here in Ecuador but they all turned me down because my credit was low but with god grace I came to know about Le_Meridian so I decided to give a try to apply for the loan. with God willing they grant me loan of 500,000.00 USD the loan request that my banks here in Ecuador has turned me down for, it was really awesome doing business with them and my business is going well now. Here is Le_Meridian Funding Investment Email/WhatsApp Contact if you wish to apply loan from them.Email:lfdsloans@lemeridianfds.com / lfdsloans@outlook.comWhatsApp Contact:+1-989-394-3740.

ReplyDeleteLife saver

ReplyDeleteWrong answers

ReplyDeleteur the best!! ty!!

ReplyDelete